Insurance coverage firms should have the ability to confirm notice was sent out but not that you received it. Tell your insurance coverage firm if your address changes. When to tell your insurance provider you got a new cars and truck While your plan define your company's demands,. A typical stipulation is 2 week, yet only four days if you do not have physical damages protection on among the vehicles already guaranteed.

In contrast to what many individuals believe, there is no regulation or policy that provides you thirty days to notify your company. The quicker you contact your representative or insurance provider, the faster you can be sure you have the protection you require.

A repair fee to recover your driver's license That vehicle may not be driven by any person while the registration is suspended WHAT ACTIVITY DOES PENNDOT TAKE IF I DO NOT HAVE INSURANCE POLICY? Or else, a gap of insurance coverage results in the suspension of your vehicle enrollment benefit for 3 months, unless the gap of insurance coverage was for a duration of less than 31 days and the owner or registrant confirms to Penn, DOT that the lorry was not operated during this brief gap in protection.

You might decide to pay the civil charge in lieu of suspension no even more than as soon as in a 12-month duration (insurance). Settlement of the civil charge, together with your repair charge as well as proof of current insurance, will certainly permit you to preserve registration on your vehicle without the need to offer a three-month enrollment suspension.

Some Of Frequently Asked Questions - Freeway Insurance

To request as well as print your restoration requirements letter, visit "Request a VR Repair Demands Letter" - cheap auto insurance. Individuals will certainly require to offer the first eight numbers of the vehicle title number, the last four varieties of the Automobile Identification Number (VIN) if the VIN is more than four numbers long and the initial two characters of the proprietor's last name or the very first two characters of the business's name if a business possesses the vehicle.

The Insurance policy Department regulates the insurer.

For this last team, it is best to speak straight with your company and, for those operating at big employers, with the human sources division (car). Just how much time do I need to pay my costs? Under present law, an insurance provider might terminate a plan for failing to pay the premium.

cheapest auto insurance insurance cheaper car insurance vehicle insurance

cheapest auto insurance insurance cheaper car insurance vehicle insurance

Throughout this duration, policies can not be terminated for nonpayment of the premium. The extensive elegance period does not alter the terms of existing insurance coverage plans.

An Unbiased View of Insurance Policy Being Canceled Non-payment? What To Do

If the plan is eco-friendly throughout the poise duration, it can be restored for the same terms if you accept. This revival is offered even if you have not paid the preliminary revival (initial repayment) during the elegance duration. Can not cancel any insurance coverage for nonpayment of premiums for the regard to the insurance policy.

Can not report late repayments to credit scores rating companies. laws. Must allow an extension of time for insurance holders to pay premiums that schedule however not paid throughout the moratorium (either 60 or 90 days depending upon the kind of insurance coverage). Insurance policy holders can pay these premiums later, either over the rest of the current plan term or in 12 months, whichever is much longer.

Can not take into consideration any kind of late payments throughout the poise duration in setting the costs of future insurance costs. Are required to place details on their internet sites as well as provide each policyholder with an easy-to-read explanation of the prolonged moratorium. Need to give a different way to make premium repayments other than in-person (for instance, online or by mail).

What should I do currently? Prolonged moratorium are not applied automatically. You should call your insurer to make the most of the emergency situation grace periods and also to discuss options to pay your premiums in time after the particular moratorium finishes. Examine your insurer's web site for info about how to do this.

The Greatest Guide To Cancellation And Nonrenewal - Nevada Division Of Insurance

Remember that there are various elegance periods depending on the type of insurance.

cars insurance company car cars

cars insurance company car cars

A note about car insurance Automobile insurance provider are called for to retroactively reduce premiums for 2 months (as of March 9) due to reduced driving. The reduced rates ought to remain basically during the proclaimed state of emergency (car insurance).

If you are considered too high of a threat or do not fulfill the insurance firms demands you might require to buy cars and truck insurance coverage from the non-standard market. Where your policy has actually been in effect for as much as 60 days, the Insurance coverage Business might only terminate your plan for a factor that they have actually filed with the Financial Provider Regulatory Authority of Ontario (FSRA), formerly recognized as FSCO - cheap auto insurance.Where your policy has actually been in impact for even more than 60 days, the Insurance Firm may just terminate your policy for one of the following reasons: non-payment of insurance policy premiumyou have offered incorrect details of the automobile or subject of insuranceyou have actually intentionally misrepresented or stopped working to disclose information that you were called for to provide in the application for auto insurancethe danger has changed materially, Obtaining cancelled for non-payment of your vehicle insurance coverage premium is one of the most convenient means to be categorized as a higher-risk motorist.

Whether you concur with that logic or otherwise, being terminated for non payment is a precise way to wind up in the non-standard automobile insurance policy market. If non repayment of your auto insurance policy costs is the reason for the vehicle plan termination then you can also wager that your payment options will decrease in the low-grade automobile insurance coverage market? Terminations for non settlement remain on your record for 3 years - insure.

See This Report about Non-payment And Insurance Cancellation Affect Insurance Rates

trucks perks low-cost auto insurance cheap car

trucks perks low-cost auto insurance cheap car

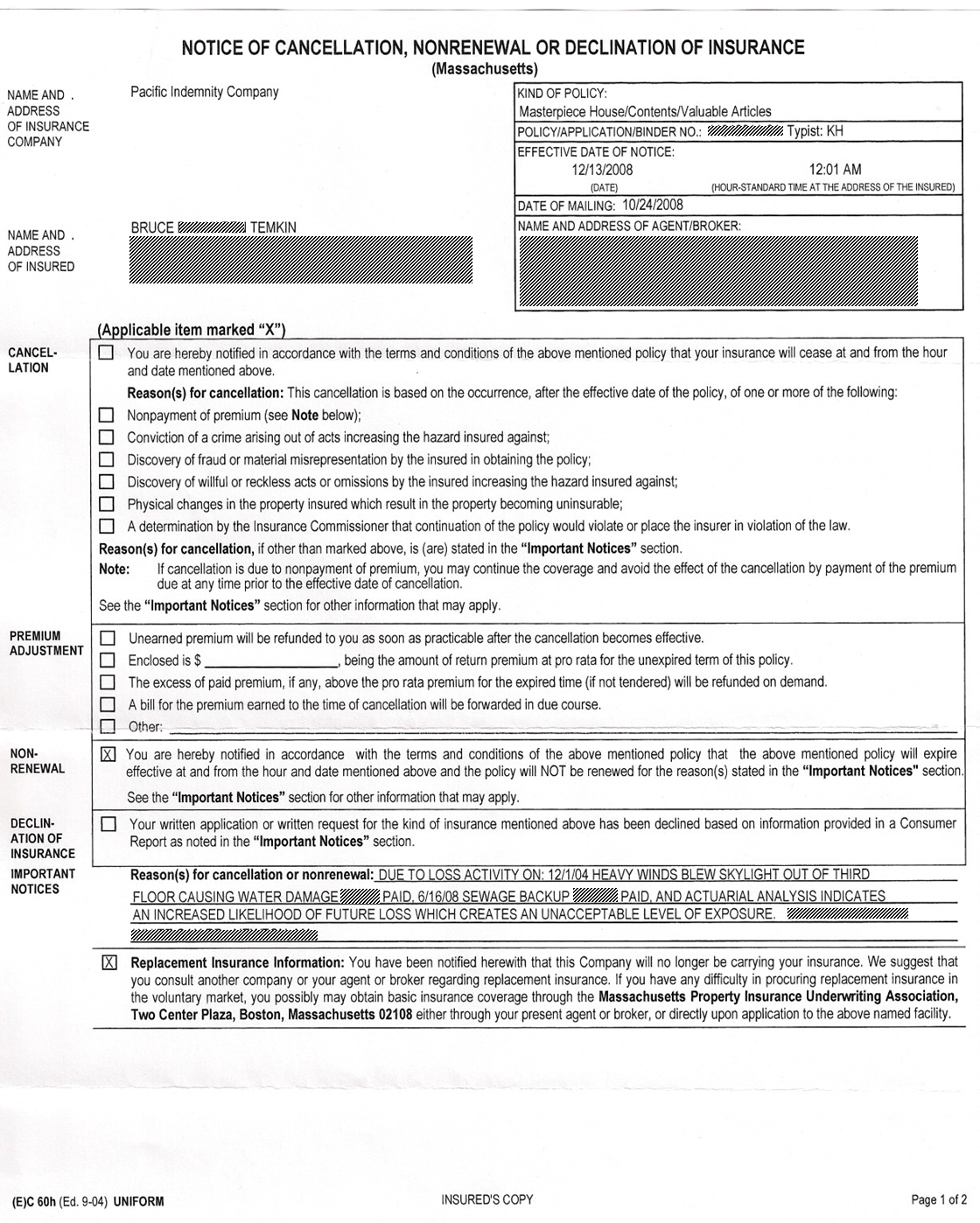

If your Insurance firm has actually dropped you as well as you get a letter of cancellation you require to discover the day when insurance coverage ends. Don't puzzle a letter of termination with a letter of non-renewal. The letter of non-renewal suggests the insurer can't expand your policy for an additional term due for not meeting eligibility - insured car.

A letter of termination generally means the Insurance policy Company is terminating you within the plan period, while a letter of non-renewal means they are not terminating you, just recommending that they can not restore your auto plan. A cancellation fee does not apply in both circumstances - cheapest car insurance. A Non-renewal letter from your automobile insurance coverage firm means you no more certify to be insured by that insurance company.

Most car Insurance firms have comparable requirements to certify or disqualify a driver from the basic vehicle insurance policy market (auto). The non-renewal of cars and truck insurance policy is not an instant termination as well as shouldn't be puzzled with a letter of termination. You can argue that a cancellation is a lot more serious as there was reason to damage the agreement of insurance policy with you.

dui cheap car insurance cheapest car auto insurance

dui cheap car insurance cheapest car auto insurance

There are several various reasons that insurance might be terminated. One is for non-payment or missed settlements. This can be a severe circumstance when it comes to your cars and truck insurance coverage. What Takes place If My Vehicle Insurance Policy Is Cancelled Charge To Non Repayment? Your insurance protection is canceled. If you have not paid your insurance policy costs by their due day then you risk of getting your vehicle insurance coverage terminated.

The Ultimate Guide To Can Your Insurance Company Drop You After An Accident?

If you know that you are going to be late with your insurance policy repayment you can call your insurance policy service provider to see if there is an elegance duration or if something can be exercised - insurers. Some insurance policy firms will be lenient with one late payment, yet beyond that, they will usually terminate your insurance coverage for non-payment.

You need to obtain a letter from your insurance firm that will plainly state which it is. This will come when it's time to restore your insurance as well as the insurance firm is declining to renew your current policy.

How Much Time Does Non-Payment Remain On Insurance Coverage? Three years. If you have had your insurance coverage canceled because of non-payment it will certainly remain on your Insurance coverage document for a duration of three years. The insurance coverage record goes back much better than that. An insurer can go back 6 years or more.

Some insurance policy companies could keep high-risk rates much longer than 3 years. It is up to the insurance coverage firm to establish its prices.

What To Do If Your Car Insurance Is Canceled - Experian Fundamentals Explained

If they were to guarantee you after that you would certainly be insured as a risky insured - suvs. Which would certainly suggest that the costs would certainly be a lot higher. A more most likely possibility would certainly be to be guaranteed by an Insurer that concentrates on high-risk insurance. Which once again implies you would be paying greater premiums.

Nonetheless, it does not instantly put you in the risky category (cheap). Oftentimes, it takes even more than one incident of this prior to the majority of insurance companies will certainly now consider you to be high danger. Additional Repercussions, Along with having actually the insurance policy terminated and higher costs as an outcome of this some of the other repercussions are: Less options of insurer that will use insurance, Few choices for layaway plan.

Exactly how Do I Obtain Insurance Coverage After Being Cancelled? Store around for a new Look at this website Insurance coverage Business.

There are loads of insurance policy companies detailed on the web. You can go with an Insurance policy broker, Insurance coverage brokers partner up with a small team of insurance policy service providers.

Little Known Questions About What Happens If Car Insurance Is Canceled?.

You can make use of among the services online that offer insurance quote services. These quote solutions work likewise to a broker other than frequently they affiliate with numerous even more insurance coverage carriers and also will certainly obtain a number of quotes which they will offer you with to allow you to choose which firm providing the quotes appeals to you one of the most.

These are governed by the Insurance policy Bureau of Canada. The Insurance firms in Ontario essentially adhere to the very same layout as every various other insurance supplier throughout Canada - vehicle insurance. Consequently when it comes to termination for non-payment they will generally comply with the very same style of canceling the insurance which causes the private having to use for high-risk insurance policy.

Don't Lie When Obtaining Quotes, With all the info that is readily available to Insurance provider probably if a candidate is much less than sincere it will be discovered during the info gathering process. Which is done when determining the costs. There are times when a lie might go undiscovered for a time period.

A very costly blunder. Exactly How To Keep High-Risk Insurance Practical? There is no question that risky insurance coverage is going to cost a great deal a lot more. If a good payment document is kept for three years there is a far better opportunity of obtaining the insurance policy premiums to the normal price.

Why Do Car Insurance Companies Cancel Policies? - Kelley ... Things To Know Before You Get This

cheap auto insurance liability affordable auto insurance car insurance

cheap auto insurance liability affordable auto insurance car insurance

It is no enjoyable having to pay risky premiums as well as every action ought to be required to avoid winding up in this scenario (cheaper cars).